december child tax credit check

The December check will arrive through direct deposit for millions of parents on Dec. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Ad Tips Services To Get More Back From Income Tax Credit.

. The amount parents receive depends on the age of the child. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and. 8 rows The IRS bases your childs eligibility on their age on Dec.

The Child Tax Credit was expanded for tax year 2021 so parents can get half of the credit early before filing their taxes in early 2022 through advanced monthly payments. Have been a US. The IRS pre-paid half the total credit amount in monthly payments from.

The enhanced portion of the credit will be available for individual tax filers with annual incomes up to 75000 heads of households making up to 125000 and couples. 31 2021 so a 5-year-old turning 6 in. Filers will receive a max credit of 3600 for each child age 5 or younger according to the IRS.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Families with eligible children will benefit from the Child Tax Credit money from the government. DMN Digital Market News.

Free means free and IRS e-file is included. When does the December child tax credit payment arrive. Based On Circumstances You May Already Qualify For Tax Relief.

Claim the full Child Tax Credit on the 2021 tax return. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The status of the child tax credit in 2022 is currently hanging in the balance.

The child tax credit wasnt new when Democrats over the objections of Republicans in Congress altered the program as part of Bidens 19 trillion coronavirus relief. Max refund is guaranteed and 100 accurate. Starting in mid-July families will receive up to 300 per child each month through December as part of the Child Tax Credit bringing economic security to an estimated 25.

When does the Child Tax Credit arrive in December. The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. Americans who qualify for enhanced Child Tax Credit benefits might be getting their final advance payments this week as the program is slated to wrap up on Dec.

For children between the ages of 6 and 17 the max credit will be 3000. Get Help maximize your income tax credit so you keep more of your hard earned money. This means that the total advance payment amount will be made in one December payment.

7 rows The IRS has not announced a separate phone number for child tax credit questions but the main. If the House and Senate pass the 175 trillion reconciliation bill the child tax credits would be. The next child tax credit check goes out Monday November 15.

Eligible families who did not. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. You should look for the.

Eligible parents get 300 for each child who is aged under six and 250 for each child aged between 6 and 17.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The Child Tax Credit Toolkit The White House

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Childctc The Child Tax Credit The White House

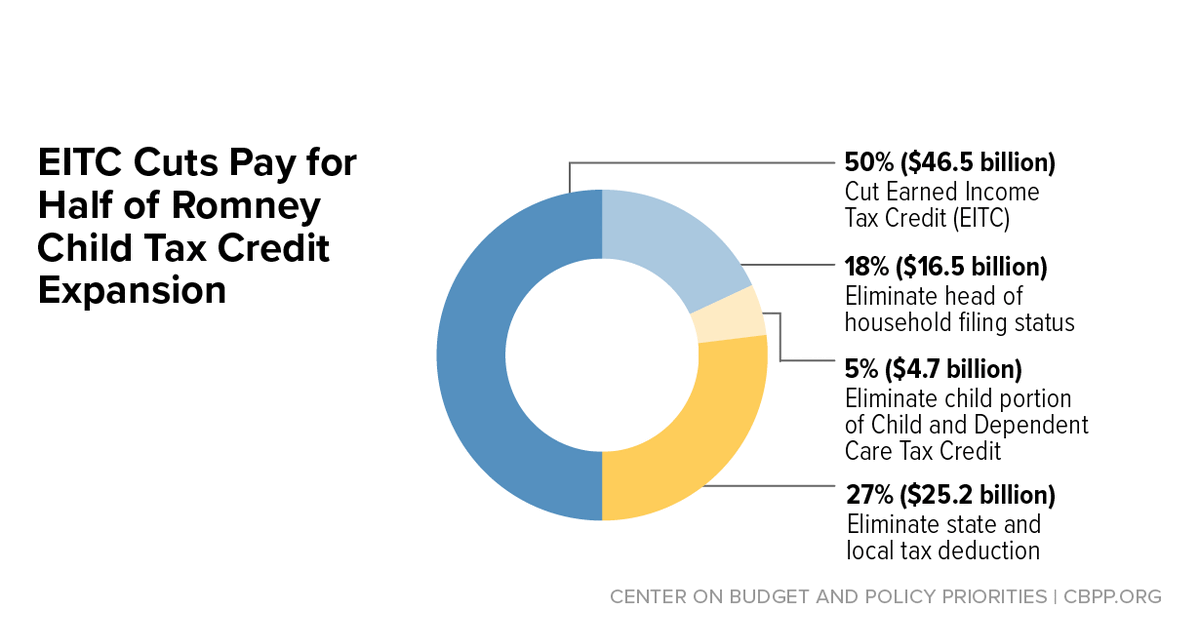

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Expiration Of Child Tax Credits Hits Home Pbs Newshour

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Did Your Advance Child Tax Credit Payment End Or Change Tas

The Child Tax Credit Toolkit The White House

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

The Future Of The Child Tax Credit Tax Pro Center Intuit

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

The Child Tax Credit Toolkit The White House

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Missing A Child Tax Credit Payment Here S How To Track It Cnet

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox